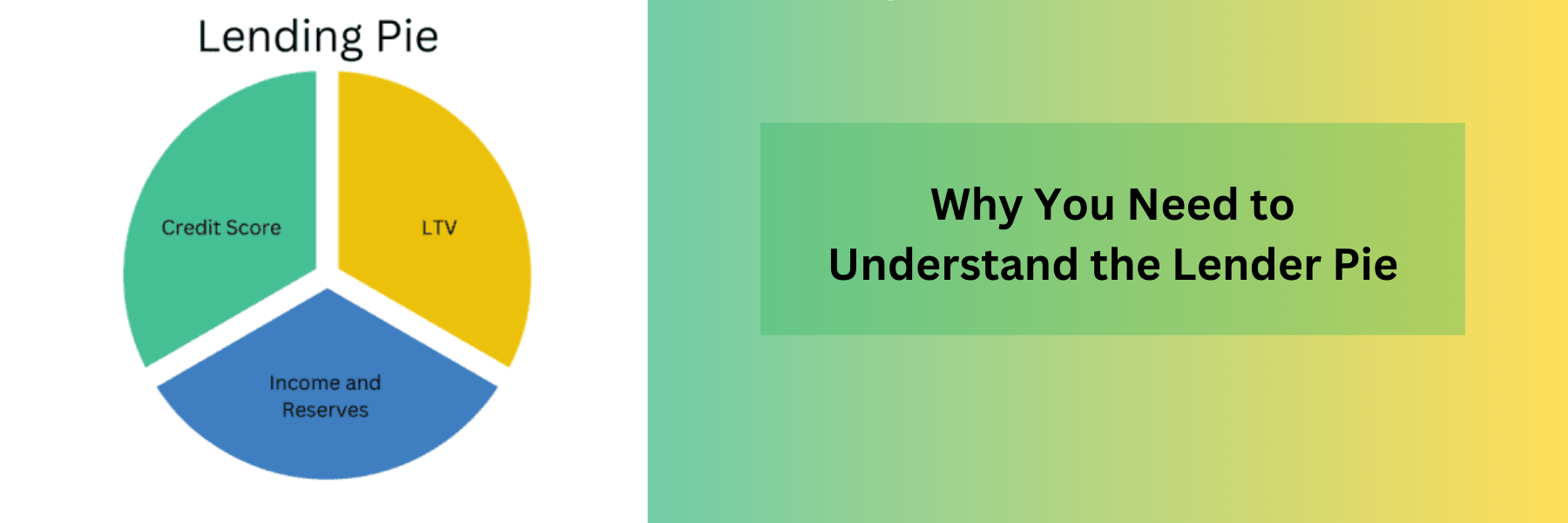

Why You Need to Understand the Lender Pie

Categories: Blog Posts

Why You Need to Understand the Lender Pie

Real estate investors often find that the biggest hurdle they face is learning the lending side of real estate. For over 23 years I have been working with investors. Many of them are just starting out and are learning how to build both income and wealth. Wealth in real estate investing is achieved by using other people’s money for leverage. It is important that you understand the lending pie, what it looks like, and how you can make it work for you. This in turn will also help you to better understand how to play the game and win in real estate.

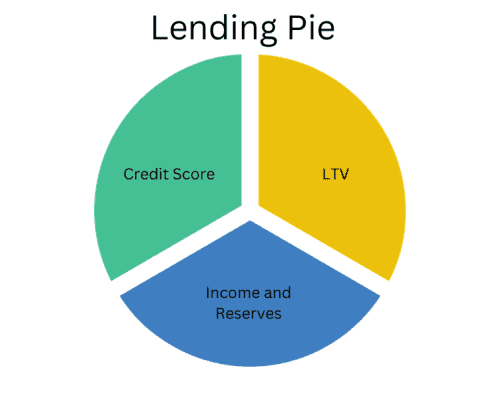

All lenders are looking for three things that make up their decision if they are going to lend to you. This includes your credit score, LTV, and your income.

1. LTV

LTV stands for the loan to value. It is determined by evaluating how much money you have in a property, how much equity you have, and what is your piece of this property. Remember if your LTV or credit score is not the perfect piece of the pie, then you may have to compensate for that with a higher rate. We want to make sure that you understand this so that you pay the least amount when you’re investing. Investing is all about creating more wealth and income by paying less on the money that you are borrowing.

2. Income and Reserves

Income and reserves can either come from you or from the property. If you’re looking at a DSCR or fix and flip, and you are going to sell it, then it is the income that the lenders will evaluate. Reserves include the amount of money you have put away in case something comes up. In regards to rental properties, it is how many months of reserves you have in case the property goes unrented for 3 to 6 months. If you’re a flipper, the reserves can help you make payments over the next 6 to 9 months until your property is sold. Depending on the situation, lenders may want a lower LTV, or may require a higher credit score to help balance things out.

3. Credit score

Lenders will evaluate your credit score and how you have paid people in the past before considering loan approval. Lending is primarily based on algorithms, and your credit score is a big determining factor. It is vital to your success as a real estate investor. The higher credit score will get you more money, a higher LTV, and it will provide more flexibility on income requirements. It is imperative for new investors to get their credit score as high as possible because it will lower the interest rates, the lower the mortgage payment, and decrease the amount of income you will need.

In conclusion

It is important that real estate investors understand the lending pie and how it impacts their success. While the lending pie is a mix between credit score, LTV, and income, the pieces are not always equal. This is because everyone’s pie is just a little bit different when lenders are looking. While LTV and income are more difficult to change, your credit score is a place where you can make the biggest impact. Be on the lookout for future videos that focus on credit and easy ways to raise your scores.

Our goal is to make sure that you are as successful as possible. Contact us to find out more about the lending pie and how you can raise your credit scores.

Watch our most recent video about The Lender Pie: 3 Key Loan Qualifications in Real Estate to find out more.