Sometimes you end up with a negative cash flow rental property. Here’s how to combat that negative cash flow.

A negative cash flow rental property can be the lesser of two evils.

If your options are to sell your flip at a loss, or shell out tens of thousands of dollars yearly interest on a bridge loan refinance… Suddenly eating a small monthly loss making the flip a rental doesn’t seem so bad.

Let’s look at the numbers behind making a negative cash flow rental property work for you.

Refinancing with Bridge Loans vs DSCR

Getting a DSCR or no-ratio loan from a new lender is typically a better move than continuing to refinance with bridge loans from your current lender.

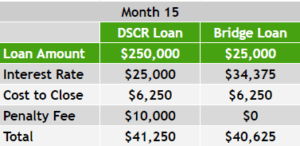

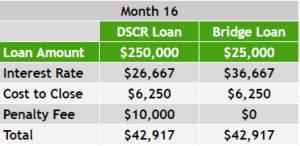

You don’t know where the market will be in 12 to 24 months. We know that long-term, the markets will come back, but what if that doesn’t happen for 3 years? You could get stuck refinancing with a bridge loan year after year, charging points with each refinance.

DSCR loans are often a better option in this situation. You just have to know your numbers.

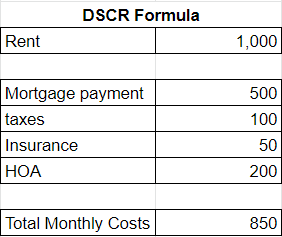

Let’s go through an example so you know exactly how to calculate a DSCR loan and see if it’s the smart choice for you.

Using a DSCR Loan on a Negative Cash Flow Rental Property: The Numbers

Let’s look at an example with a $300,000 loan. We’ll assume that both the original flip loan and the DSCR loan you’re refinancing into are interest-only.

This $300,000 flip loan has a 10% interest rate. That means you’re paying $2,500/month just for interest. This is the current negative cash flow of the property.

On the other hand, if you can get a DSCR loan for a 7% interest rate, you’d be paying $1,750/month instead. Plus, you could get a tenant renting for $1,800/month.

At this point, $1,800 would be coming in, and $1,750 would be going out for mortgage payments. This is actually a positive cash flow of $50/month.

However, your mortgage isn’t your only expense on this property. We still have to take taxes and insurance into consideration. Let’s say both of those costs add up to $300 per month.

This raises the total expenses with a DSCR loan to $2,050 per month, bringing the cash flow to a -$250 every month.

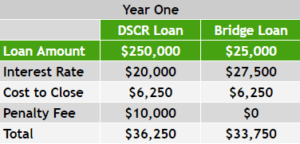

Flip Loan vs DSCR Loan Compared for a Negative Cash Flow Rental Property

Obviously, you never like to lose money on a property. But that $250 of negative cash flow multiplied by 12 months is only $3,000. After 2 years, it’s $6,000. That may seem like a lot, but let’s look back at what you’d spend with the original flip loan.

If we go back to our example, remember we’d be paying $2,500 per month in interest, plus $300 in taxes and insurance with the original flip loan. That’s $2,800 spent for 1 month with the flip loan – close to the $3,000 for the full year with a DSCR loan!

If you keep the house on the market with this flip loan for 2 months, it’s $5,600. That’s comparable to 2 years of out-of-pocket costs if the same property was converted into a rental.

Is Negative Cash Flow Worth It?

This is how you have to look at the numbers in this scenario. It will help you determine what’s right for your flip. Is it better to wait for the market and shell out thousands of dollars in the meantime? Or rent the property with a little negative cash flow for 2-3 years in hopes of recouping an extra $100k in equity when the markets come back? (Or at least until rates come back down so you can refinance?)

In many cases, it makes more sense to turn your flip into a rental ASAP. A negative DSCR or no-ratio loan is how to combat that a negative cash flow.

Read the full article here.

Watch the video here: