Why You Need More Bridge Loans in 2022

Categories: Blog Posts

The real estate market is changing. Here’s what you need to know about bridge loans in 2022.

Have you used bridge loans for your portfolio in the past?

In 2022, all money sources are tightening for real estate investors. Interest rates are rising, banks are reluctant to lend, and lender requirements have shot up.

You might find you’ll need more bridge loans than ever before.

Here are 3 ways you can use bridge loans for real estate investing in 2022.

1. Gap Loans to Supplement Hard Money

In the current market, lenders’ priority is to lower their risk. Many hard money lenders are limiting loans to 65% of the after-repair value (ARV).

If you could still complete a project under-budget at 65%, you’ll be able to find a lot of funding options. But if your project will take more than 65% of the ARV to complete, you might need to bring in a bridge loan.

A bridge loan can fill the gaps left by a hard money loan – whether for a down payment, rehab expenses, or carry costs.

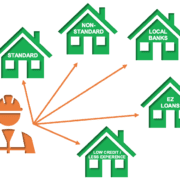

You can get a bridge loan from:

- A hard money lender

- A hedge fund

- Real OPM

OPM (Other People’s Money) is the ideal option for this type of gap funding. OPM is real money from people you know. It can be used to bridge gaps in investments, refinance hard money, and more.

2. Buy a New Property with Bridge Loans in 2022

Another effect of the upcoming market is the amount of time houses will take to sell.

Instead of selling in two to three days, we’ll soon see houses taking two to three months to sell, depending on size and location.

Your investment career can’t come to a halt just because a house takes too long to sell. What if you find a great deal while your old project is still on the market? All your capital is tied up in that first property.

Bridge loans solve this problem.

A bridge loan puts a lien on both the new property and the old property. This gives you the equity needed to close on a new house before the money from selling the old one hits your pocket.

Bridging from one property to the next like this is the number one way investors use bridge loans.

3. Bridge Loans for Wholesalers

Wholesalers use bridge loans, too. Sometimes called “transactional” or “wholetailing” loans, these short-term funds are also a type of bridge loans.

This type of loan bridges a very small gap. Usually, it’s just the money needed for one day until the buyer’s money comes into the title company.

With these types of bridge loans, it’s important for wholesalers to find a lender who will give 100% financing, without overcharging.

What to Look For In Bridge Loans in 2022

Bridge loans are all about getting the right lender and the right position.

Terms of a Bridge Loan

It’s important to pay attention to the terms of a bridge loan. You want a lender who charges fewer points – even if their interest rate is higher.

You only have to pay interest in small, monthly chunks. With points, you have to pay a percentage of the whole loan. Since bridge loans are very short-term, you won’t end up paying much in interest anyway. However, you’ll still have to pay the points (regardless of how long you kept the loan).

Shop Around for Lenders

Make sure you shop around for the right lender for your bridge loan. Find out who does bridge loans, who can do them quickly, and who focuses more on the interest rate rather than other costs (originations, appraisals, etc.).

Bridge loans are meant to be quick, short-term, and relatively inexpensive. You want to find a lender who can provide that.

How The Cash Flow Company Can Help

The Cash Flow Company offers DSCR loans, traditional loans, and blanket loans. Plus, we have the flexibility of hard money.

If you have any questions about bridge loans in general or our bridge loans in particular, reach out!

Email us with a specific deal or question at Info@TheCashFlowCompany.com.

Join our weekly call where we work with investors’ deals in real time, every Thursday from 1:15 PM – 2:15 PM MST.