DSCR Loans: Top 3 Questions Everyone Is Asking

DSCR has really been taking off in the last 6 months! Today we are going to talk about the top 3 DSCR loan questions everyone is asking. As rates continue to come back down and properties start to cash flow again, many investors are coming back to DSCR. It is an excellent product for real estate investors to use for their next property!

First, can you get a DSCR loan for more than 4 units?

Typically there is a lending box that you fit into when you own a 1 to 4 unit. As a result, those who have 1 to 4 units have a lot of loan options available. We have had a lot of questions regarding lending options for properties that are not in that range. Anything over 5 units is considered a commercial property. Here at The Cash Flow Company we are working with a few investors who have an 8 plex, 12 plex, and even a 24 plex. For these customers, there are DSCR options, however they are considered commercial loans. Commercial loans are just a little bit different, but there are more options available now then there were in the past.

Second, what kind of documents do you need when you are applying for a DSCR loan?

If you are doing a refinance, you will need:

- Lease agreement – What are you leasing?

- Business setup – What is the operating agreement and who runs the company?

- Reserves – You need a couple months of bank statements that show 2-3 months of reserves.

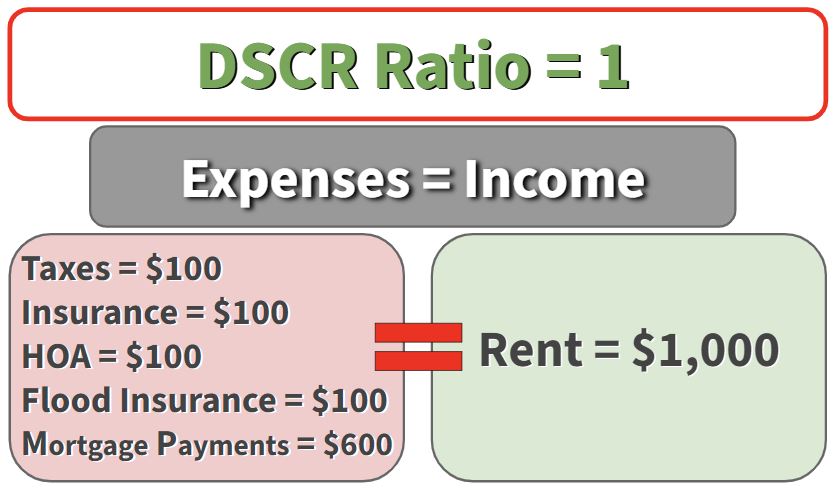

- Taxes – Needed for DSCR ratio.

- Insurance: Needed for DSCR ratio.

- HOA – Needed for DSCR ratio.

- Flood – Needed for DSCR ratio.

- Title

- Appraisal – An appraisal will show the value of the property.

Once you have the appraisal and everything you need for the DSCR, it normally takes 2 to 3 weeks before everything is finalized.

Third, what happens if the property doesn’t break even?

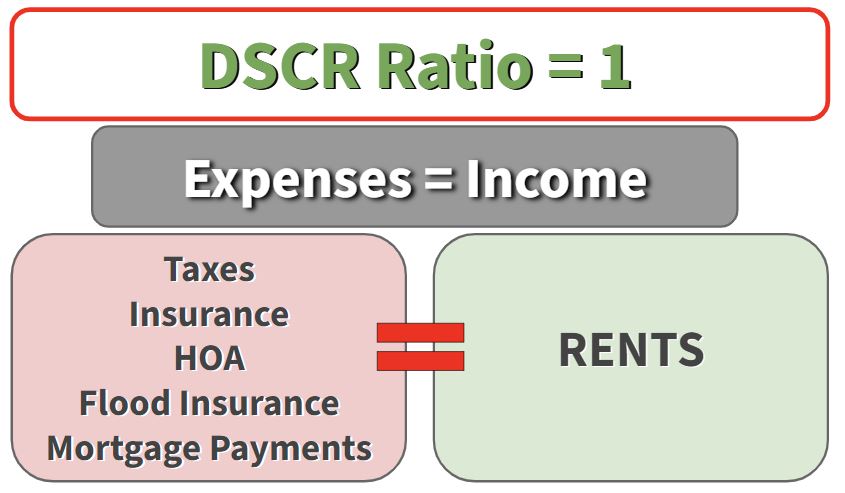

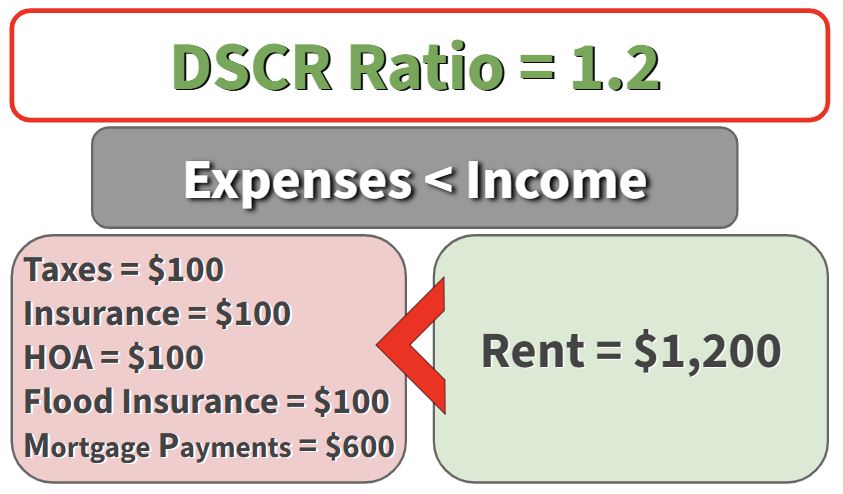

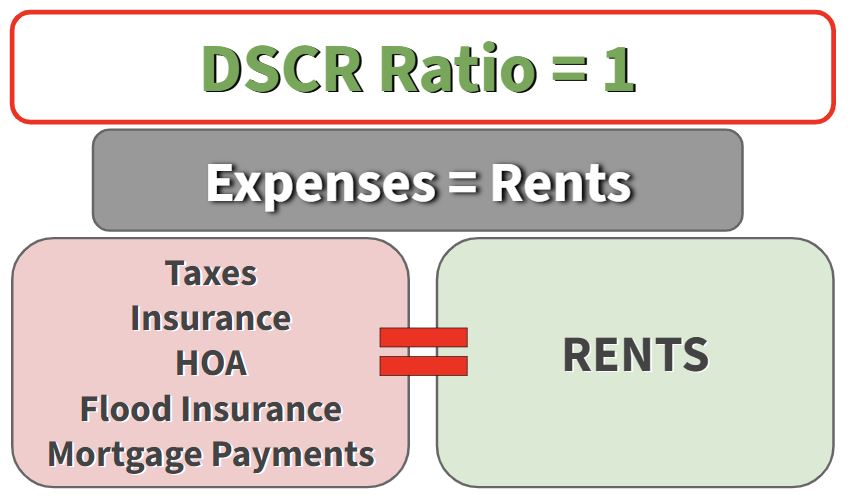

The DSCR ratio is what everything is based on. The DSCR ratio is the breakeven point where the rents equal the expenses on that property. Just to clarify, expenses include your payments (principle and interest), taxes, insurance, HOA, and flood insurance. When the rents are equal to the expenses, there is a DSCR ratio of 1. If the property is not cash flowing, then the DSCR ratio will be less than 1. While there are still options available for investors whose ratio is less than 1, it is often at a higher interest rate and lower LTV. There are options for no income as well that will go down to 75%, while other lenders might not even check income.

There is something for everyone!

DSCR loans have a lot of options available to fit your investment needs. Whether or not you have a break even property, or one that is struggling to cash flow, there is something for everyone. DSCR is becoming more of a mainstream option for investors. What types of properties are growing in DSCR popularity? The answer is commercial, 5 units, rural properties and many others. These properties no longer have to fit in the lending box. DSCR is opening the doors to endless possibilities. Do you have a unique rental property and are looking for more lending options? If so, contact us today to find out more about DSCR loans and how you can get under the DSCR umbrella!

To find out more about DSCR loans and calculate your DSCR ratio contact us today!

Watch our most recent video DSCR Loans: Top 3 Questions Everyone Is Asking to find out more!