Funding strategies for PadSplits

Categories: Blog Posts

Funding strategies for PadSplits

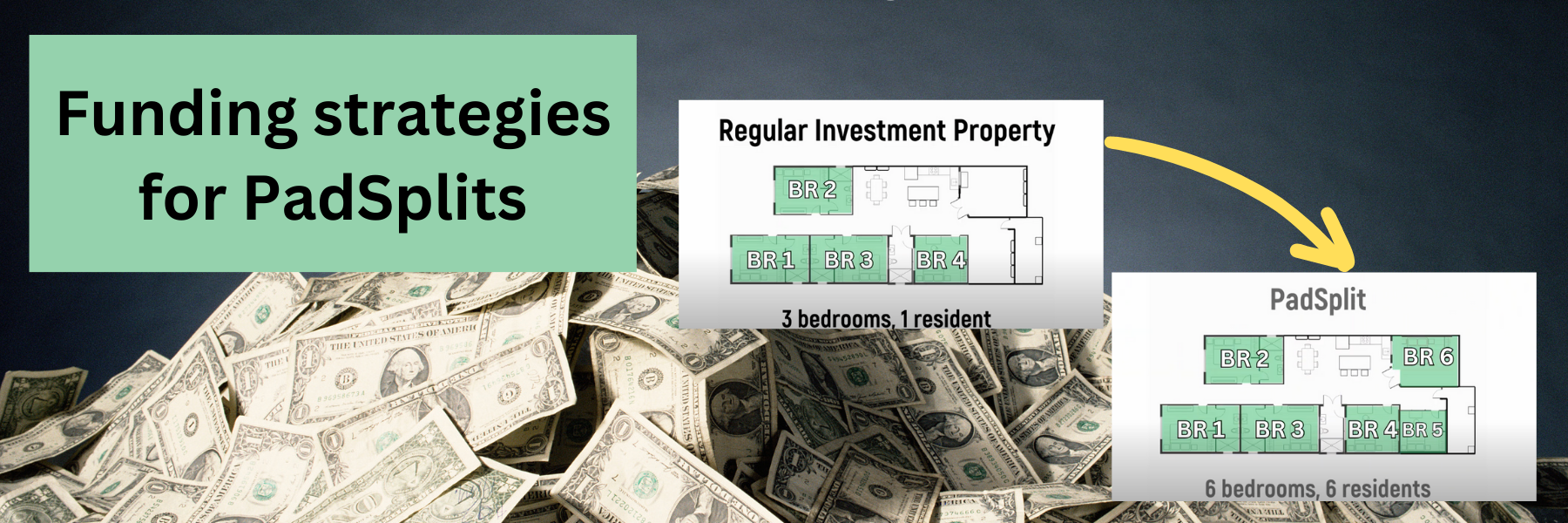

Today we are going to discuss some funding strategies for PadSplits. PadSplits are something that will be growing more and more popular in the near future due to affordability. Creating a PadSplit property will double and even triple your income off of a property. How can you fund a PadSplit? Let’s take a closer look!

What is a PadSplit?

A PadSplit takes a regular house that is a 3 bedroom/1 resident, and converting it. The property will then have 6 to 8 bedrooms/6 to 8 residents. To clarify, individuals rent the property by the bedroom as opposed to renting the whole house. These bedrooms are a suite and would have a private bathroom attached. Only the kitchen is a shared space. Each bedroom can then be rented by the week, month, or year depending on individual needs. A PadSplit property creates an affordable property for investors because they get 2 to 3 times the rent for the same property.

How do you finance a PadSplit?

PadSplits are a newer concept in real estate investing. That means that they are new to the lending community as well. Investors need to approach this strategically to get the funding they need to be successful. Right now there is a more limited market for PadSplits, however, down the road, it will become a more common. Here at The Cash Flow Company we receive a lot of inquiries regarding PadSplits and the financing options that are available. Let’s take a look at some of the options that are available for pad splits.

- The most important thing that you need to do is to get it funded before splitting it up. Get the property locked into a 30 year loan before dividing it into multiple units.

- There are also options under commercial for DSCR that could be used for PadSplits. These options are continuing to grow and there will be more available in the next few months.

- If you are looking for a refinance and you already have a PadSplit it is important that you have 12 months of experience and can show the numbers from bank statements or PNL from your company. This would allow us to use the income from the property to refinance the property

Is a PadSplit right for you?

We are here to help answer your questions regarding PadSplits and run through the numbers with you to see if it’s right for you. If you do it right and make your payments, you will have the opportunity to make a lot of money! Contact us today to find out more and get in before everyone else does!

Watch our most recent video to find out more about Funding strategies for PadSplits.