How can you use estimated rent to get a clear understanding of DSCR loan requirements?

When getting into the DSCR game, it’s important to run some numbers on the front end to evaluate potential deals.

How do you know if your property is going to meet DSCR requirements? What’s the minimum loan you’ll need, and what’s the maximum you can shop for the purchase price?

Today we’re going to look at these calculations, walking through how you can get pretty good estimates for these numbers using the DSCR ratio and the average rent rate in your local area.

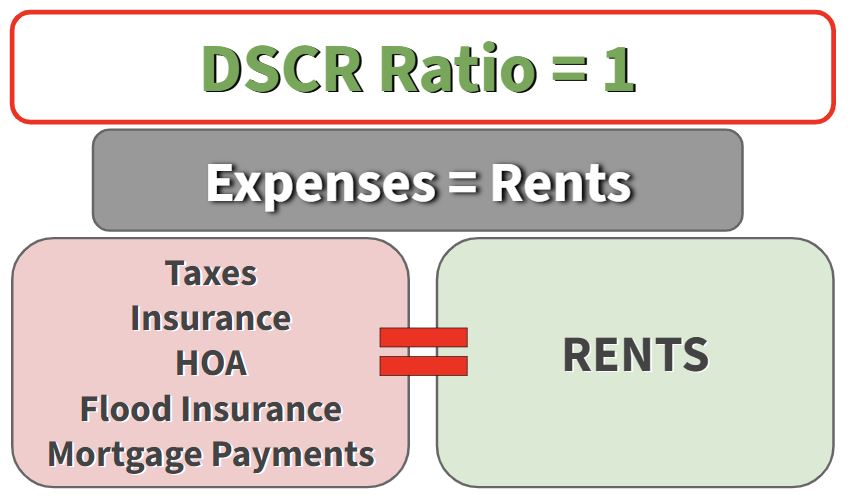

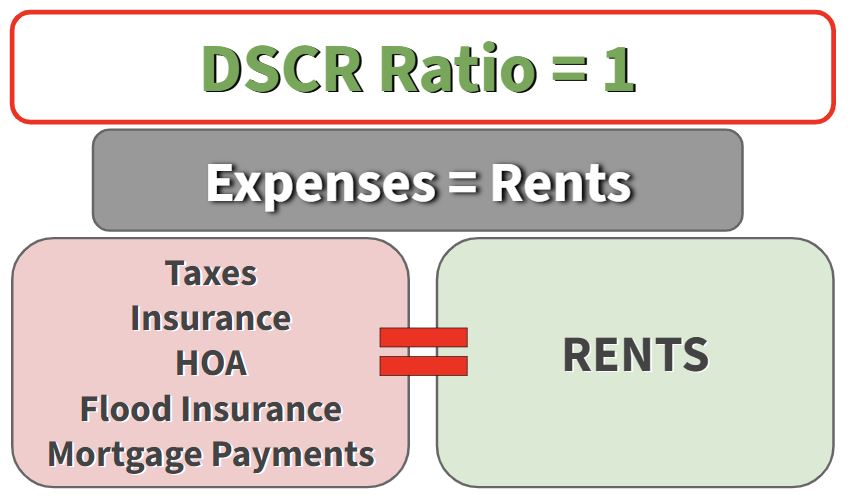

What is a DSCR Ratio?

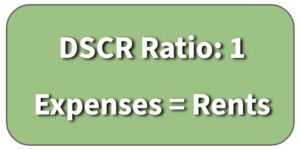

The DSCR ratio is simply the break-even point for that property. Essentially, if the DSCR ratio equals 1, then the total cost of the project is canceled out by the incoming rent.

These costs are decently easy to estimate by talking to other investors in your area. You can often find HOA or tax information online which will help you figure these numbers.

Understanding the DSCR ratio is the foundation for successful investing.

By building your investment strategy off of this ratio, you know that, at the very least, you’ll break even by sticking to a DSCR ratio = 1.

Once you’re sure you can break even, you can even set your rents slightly higher (or try to keep costs lower) to have a higher ratio of 1.25 (where you’ll have 25% higher income than outgoing cash). This typically comes in a later step which you can read about in a previous article.

Calculating Maximum Loan Amount Using the DSCR Ratio

1. Figure Out Local Rents

Using resources like Zillow or rent.com, you can look around to find standard rents for your area. This is the first step in getting future estimates (such as loan total, purchase price, etc.).

Don’t start spending money before calculating whether or not you’ll actually be able to pay those costs back.

Let’s say standard rent in the area is around $2,500. This means that, in order to break even, we need to keep all of our monthly expenses below that $2,500.

- Rents = $2,500

- Expenses ≦ $2,500

2. Monthly Expenses

For this example property, there are three monthly expenses. Taxes, insurance, and HOA fees. Other properties might have additional insurance or fees, so make sure you look at the neighborhood.

Here’s what we’re looking at for this example:

- Taxes: $1,200/year ($100/mo)

- Insurance: $2,400/year ($200/mo)

- HOA: $200/month

- Total Monthly Expenses: $500

Obviously at this point in the process, these numbers are only estimates. However, if you do research to have informed estimates, you can save a lot of money and headache down the road.

3. The Leftover = Maximum Mortgage Payments

If our estimated rent is $2,500/month and we subtract our $500 of monthly expenses out of that number, we’re left with $2,000/month.

- $2,500 (income: rent) – $500 (expenses) = $2,000 (leftover)

Now we’re ready to talk about the mortgage.

The leftover $2,000 is the maximum you could pay each month towards a mortgage.

If we want to qualify for a DSCR and keep our ratio at 1, this gives us our upper limit.

Translating Expected Expenses Into Your DSCR Loan

So, how do we take this $2,000/month number and translate it into DSCR loan requirements?

How much could you afford in a loan?

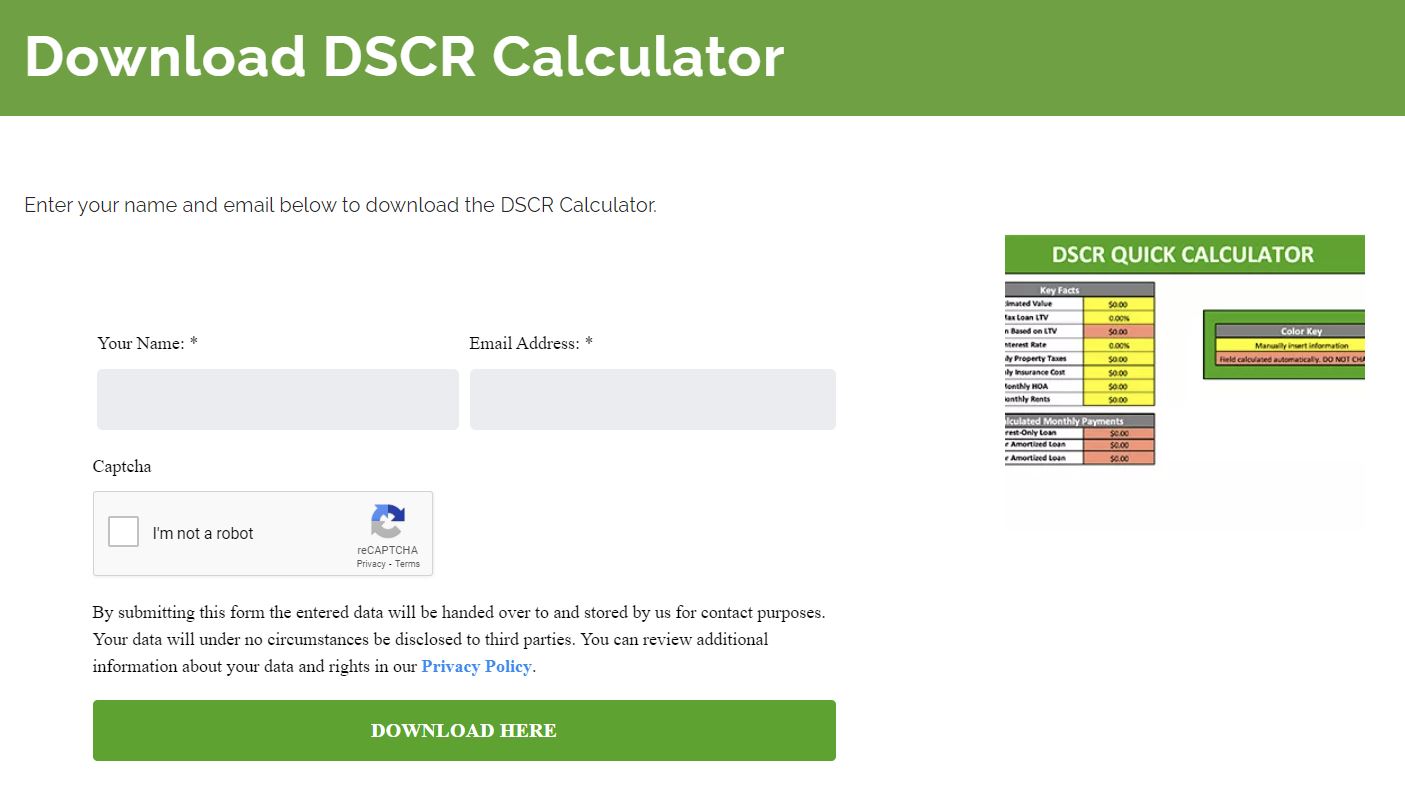

The easiest way is to use our updated DSCR calculator. It’s free to download and easy to use!

By inputting the current estimates, you should be able to get a pretty good idea of what sort of DSCR loans you’ll qualify for.

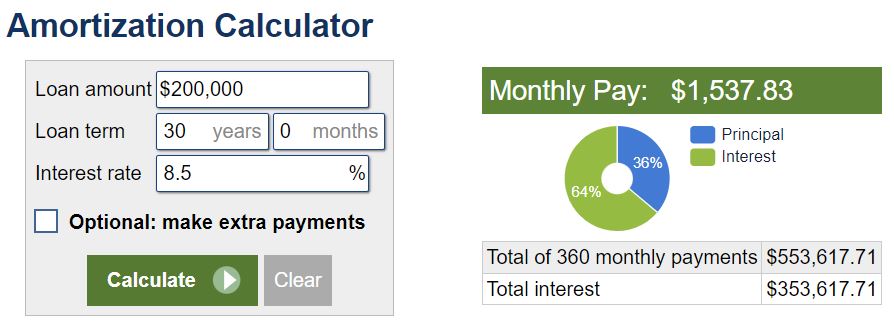

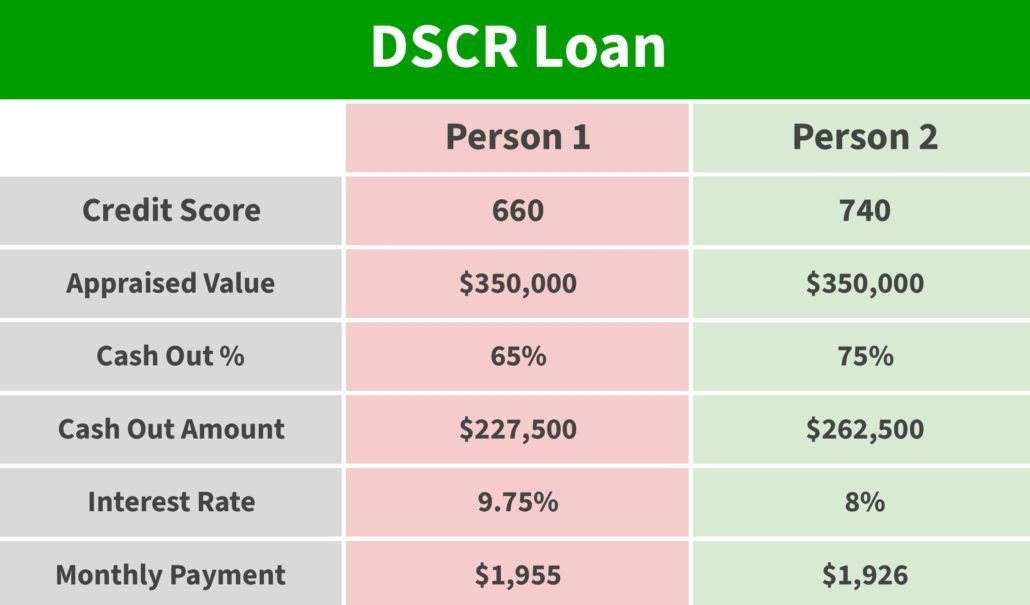

Our current estimate would likely qualify for an 8% interest rate on a 30 year mortgage.

With those numbers, we can now really start planning.

The Maximum Loan Amount

As we mentioned above, we recently updated our DSCR calculator to include a worksheet that helps you figure out your maximum loan. Even if you’ve downloaded the calculator before, you can redownload to get the updated version.

You can also use sites like calculator.net, input the numbers, and see what you’re working with.

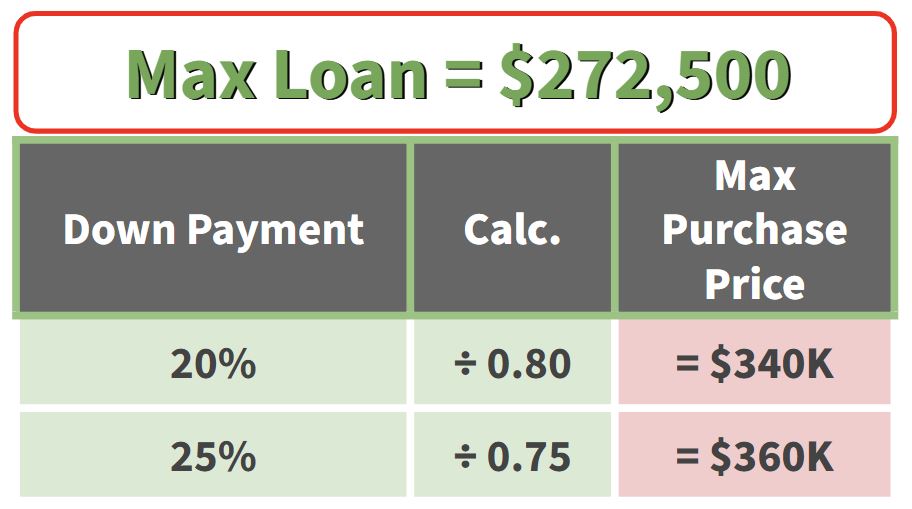

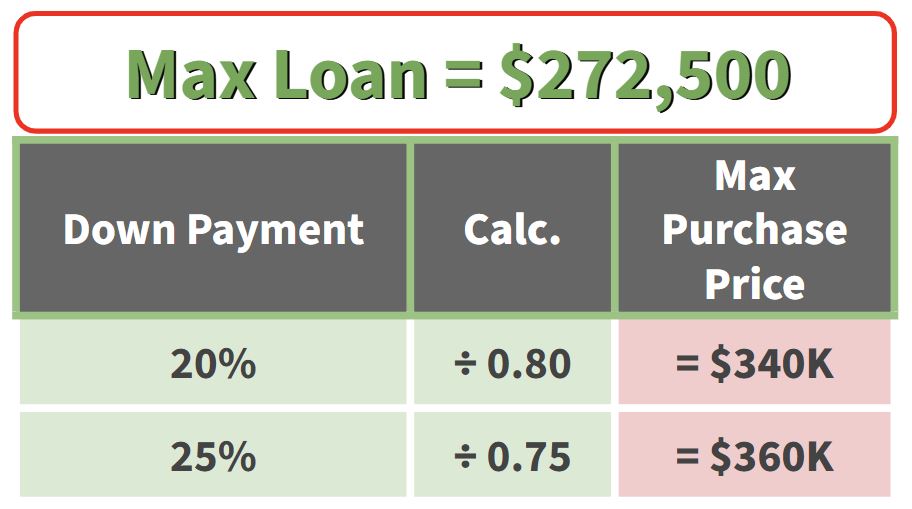

Once we use our DSCR calculator, we discover that the maximum loan we can get and still keep our DSCR ratio at 1 is around $272,500.

Putting It All Together: Purchase Price

If our maximum loan is $272,500, this helps us know what to look for in a property. The goal of real estate investing is to leverage other people’s money to ultimately turn a profit for yourself.

So if we use that loan amount and we estimate a potential down payment of 20% or 25%, what sort of purchase price can we look at?

Our DSCR calculator has a worksheet that will also walk you through these calculations, but you can see in the graph above that we can look for properties in the $350,00 bracket.

Once again, looking at DSCR loan requirements, we know we need to have a plan to break even to qualify.

Work Backwards Before You Work Forwards

You’d be surprised how many people call us because they bit off a deal they couldn’t chew. It takes time to research the rents and expenses, but it’s worth it to protect your investments.

By working backwards from the estimated rents and fees, we were able to determine both our loan and the maximum purchase price.

This method is ultimately built on the foundation of maintaining a DSCR ratio of 1 or better to ensure that we’re never losing money in our investments.

If you need help with this or if you want us to run through some numbers, we’re happy to help. Just email us at Info@TheCashFlowCompany.com.

You can also visit our YouTube channel for more tips and tricks for creating wealth through real estate investing.