How to Calculate DSCR Loan Amount

Categories: Blog Posts

How can you use the DSCR ratio to calculate DSCR loan amounts?

When getting into the DSCR game, it’s important to run some numbers on the front end to evaluate potential deals.

How do you know if your property is going to meet DSCR requirements? What’s the minimum loan you’ll need, and what’s the maximum you can shop for the purchase price?

Easy. Start with the DSCR ratio, and then walk through these steps to figure out your payments.

Calculating DSCR Loans

1. Figure Out Local Rents

Using resources like Zillow or rent.com, you can look around to find standard rents for your area. This is the first step in getting future estimates (such as loan total, purchase price, etc.).

Don’t start spending money before calculating whether or not you’ll actually be able to pay those costs back.

Let’s say standard rent in the area is around $2,500. This means that, in order to break even, we need to keep all of our monthly expenses below that $2,500.

- Rents = $2,500

- Expenses ≦ $2,500

2. Monthly Expenses

For this example property, there are three monthly expenses. Taxes, insurance, and HOA fees. Other properties might have additional insurance or fees, so make sure you look at the neighborhood.

Here’s what we’re looking at for this example:

- Taxes: $1,200/year ($100/mo)

- Insurance: $2,400/year ($200/mo)

- HOA: $200/month

- Total Monthly Expenses: $500

Obviously at this point in the process, these numbers are only estimates. However, if you do research to have informed estimates, you can save a lot of money and headache down the road.

3. The Leftover = Maximum Mortgage Payments

If our estimated rent is $2,500/month and we subtract our $500 of monthly expenses out of that number, we’re left with $2,000/month.

- $2,500 (income: rent) – $500 (expenses) = $2,000 (leftover)

Now we’re ready to talk about the mortgage.

The leftover $2,000 is the maximum you could pay each month towards a mortgage.

If we want to qualify for a DSCR and keep our ratio at 1, this gives us our upper limit.

Translating Expected Expenses Into Your DSCR Loan

So, how do we take this $2,000/month number and translate it into DSCR loan requirements?

How much could you afford in a loan?

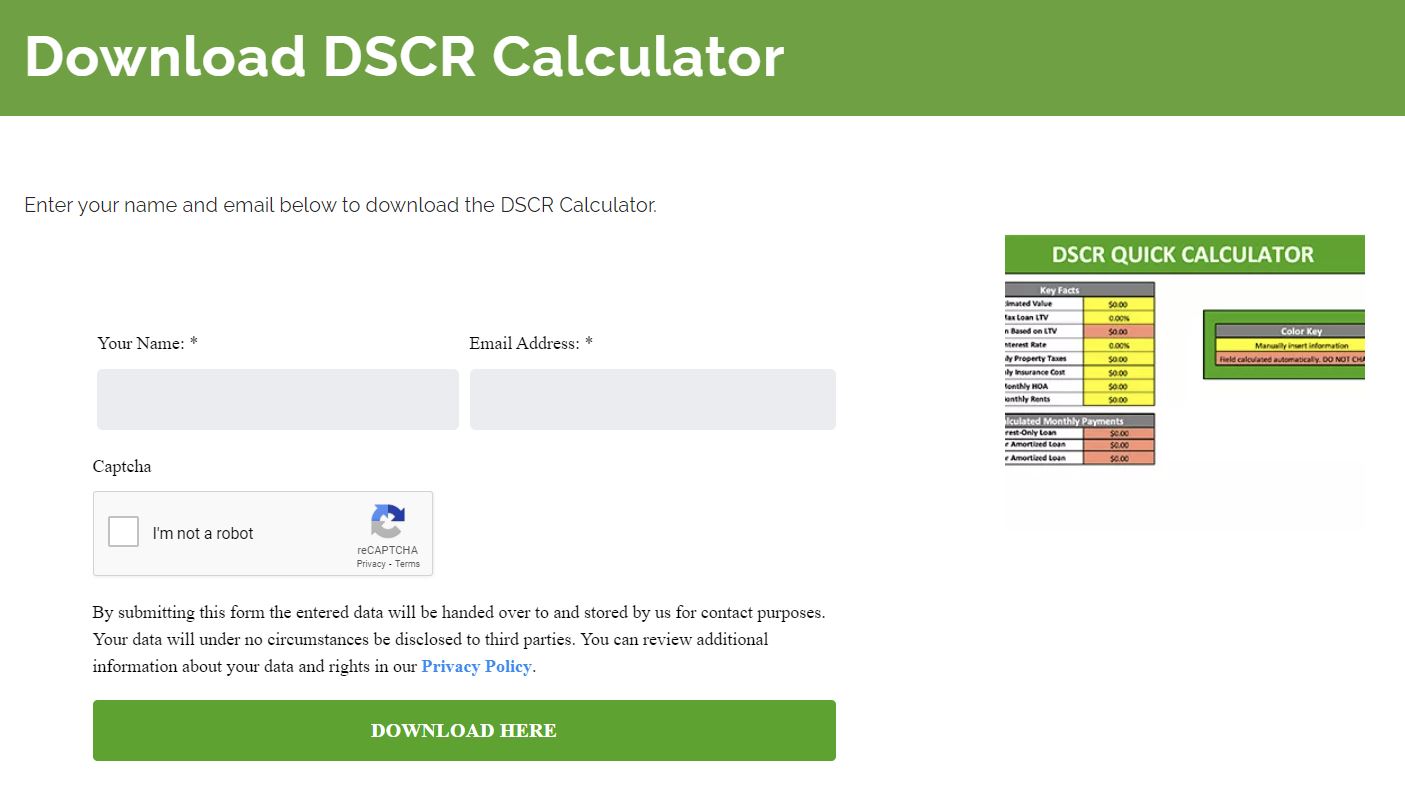

The easiest way is to use our updated DSCR calculator. It’s free to download and easy to use!

By inputting the current estimates, you can use this download to calculate DSCR loan requirements. What do you qualify for? What terms can you expect?

Our current estimate would likely qualify for an 8% interest rate on a 30 year mortgage.

With those numbers, we can now really start planning.

The Maximum Loan Amount

As we mentioned above, we recently updated our DSCR calculator to include a worksheet that helps you figure out your maximum loan. Even if you’ve downloaded the calculator before, you can redownload to get the updated version.

You can also use sites like calculator.net, input the numbers, and see what you’re working with.

Once we use our DSCR calculator, we discover that the maximum loan we can get and still keep our DSCR ratio at 1 is around $272,500.

Read the full article here.

Watch the full video here: