Leverage/loans are the key to building a successful real estate business. Credit scores are becoming more and more of a factor on who is approved for loans and or denied.

All serious investors must understand how to win at the lending game. A large part of that is understanding and managing your credit score.

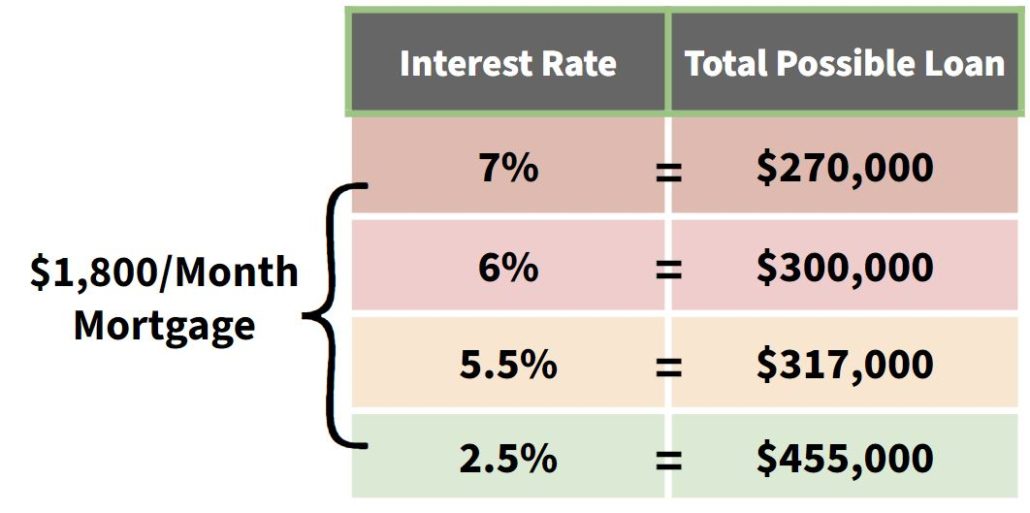

Better scores equal better loans. Better loans help create wealth and income faster.

How Your Credit Score Impacts Loan Approval

Lenders use your credit score when deciding if and how they offer you credit, such as mortgage, car loan or a credit card. Your score also affects terms and rates associated with these loans.

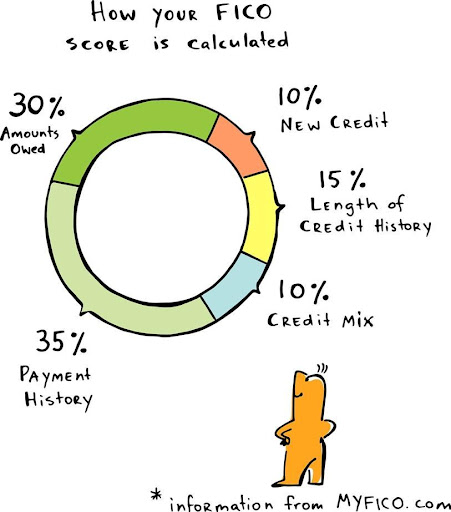

Your payment history is the cornerstone of your credit score, but other elements also play a part. These could include:

Your credit score is a number.

Lenders use your credit score to assess your risk as a borrower, using data reported to credit bureaus such as Equifax(r), Experian(r), and TransUnion(r).

Your credit score can have an immense impact on your life. It can determine whether a lender approves of an application for a mortgage.

Your credit score takes into account how you’ve paid past bills and the debt that’s currently outstanding, along with your mix of accounts (credit cards, retail accounts, installment loans (car or student loans) and finance company accounts). Lenders also look at how long it has been used; generally speaking it should remain under 30%.

Your credit score is a factor.

Many individuals don’t realize how important their credit score is in loan approval decisions. Lenders use it to assess whether someone should qualify for mortgage, business loans as well as determine interest rates that borrowers will pay on these loans.

One of the key factors affecting one’s credit score includes length of history, debt-to-credit ratio, payment history and types of accounts held. An equally significant element is how long since any negative event such as missed payments or bankruptcy occurred. Either can have an enormously detrimental effect on one’s score.

Lenders prefer to see a mix of retail, finance company and installment loans in your credit profile. Too many new accounts may raise red flags.

Your credit score is a red flag.

Lenders use credit scores to gauge whether or not someone will repay what they borrow. A higher score demonstrates responsible financial behavior. Higher scores will help qualify an applicant for better terms on loans.

Your credit score is determined by many factors, including payment history, amounts owed, length of credit history, new accounts opened and mix. One keyway you can improve your score is paying debts on time: this component accounts for 35% of FICO scores and 30% of VantageScores.

Excessive new account activity can also lower a credit score. This factor is measured by the total number of hard inquiries on your report; these could include applications for new credit as well as inquiries made by lenders to pre-qualify you for loans or credit cards.

Your credit score is a good thing.

Your credit score demonstrates your reliability as a borrower and determines the likelihood that a lender will approve of you for a loan. Furthermore, it affects interest rates you will pay, potentially saving thousands over the course of your loan’s lifespan.

FICO or VantageScore scores are calculated based on information found in your credit reports. This information comes from the three major bureaus, which contain payment history, utilization rates and age information of accounts.

Setting and making regular on-time payments are two effective strategies for increasing your scores, along with keeping revolving balances to an absolute minimum. Lenders tend to prefer when their borrowers use no more than 30 percent of available revolving credit available. Having multiple types of loans like mortgages, auto loans, and credit cards may also boost your score. Keep in mind that your score may change with new information appearing in your report over time.

Need a loan to increase your score in less than 30 days? Credit score usage loan.

How Your Credit Score Impacts Loan Approval. Credit usage loan.