How Interest Rates Impact Sellers and Buyers

Categories: Blog Posts

Rising interest rates impact both buying power and selling price. Here’s how.

When interest rates change, the monthly payment people can afford doesn’t. This results in buyers’ available price points dipping lower and lower.

People might be willing to pay a little more per month for a higher purchase price in this market. But that doesn’t matter if they can still only qualify for a loan with the original lower payment.

Let’s look at a real example from one of our recent clients about how they need to price their current flip.

Interest Rates’ Impact

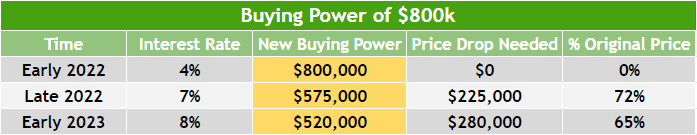

Back in January, our client’s property would have sold for $800,000. That number was still on their mind as they brought the house to market a couple months ago.

However, back then, the interest rate would have been around 4%. This would have made the property’s monthly payment around $3,800.

Fast forward to now. If people are buying properties based on payment… Could this client still sell for $800,000?

The problem is: interest rates are now closer to 7%.

Let’s look at how this impacts payment. If someone could qualify for the $3,800 payment back in January… then they qualified for that payment, not necessarily that purchase price.

If the target buyer can only budget/qualify for $3,800, then in order to keep that monthly payment with a 7% rate, the new price will need to be $575,000.

Why Is It Important to Know How to Price a Flip?

This client’s main motivation is that they want to clear off properties like this because they know better deals are coming. They need to be free to buy soon without past flips hanging over them.

Another motivation is: they don’t want to keep making payments on a property that will sell for even less in a year.

Next year, experts anticipate interest rates will be up to 8%. Affordability for this property would go down to $520,000. This client certainly doesn’t want to be caught with this property for sale in that market.

Read the full article here.

Watch the video here: