How to 5X Your Real Estate Investments

Categories: Blog Posts

Leverage can 5x your real estate investments. Let’s look at how.

Should a real estate investor ever avoid leverage? Should they always use cash when possible?

Short answer: nope.

Using leverage can help you 5x your real estate investments. Let’s take a simple example to show how it works.

Cash vs Leverage

First off, we’re going to use simple numbers in this example.

Of course, home costs and rent costs will change in different markets and different areas. But we’ll run with these numbers – even if they aren’t 100% accurate, they’ll paint a good picture of the math that backs up leverage.

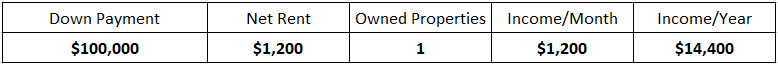

Let’s say you have $100,000 at your disposal that you want to invest in real estate.

Income Real Estate Investing with NO Leverage

To begin with, you could take all the money and buy one property valued at $100,000 outright. You’d invest the full $100k, own the house free and clear, and receive $1,200 of net rent income per month.

This adds up to $14,400 per year you’d earn from a house you fully own.

Income Real Estate Investing WITH Leverage

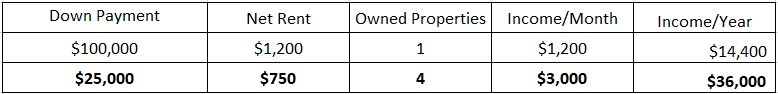

Now let’s see how it plays out when you involve a lender rather than buying outright.

You could offer to put down $25,000, and the lender might agree to loan you the other $75,000. That $75,000 covered by the lender would be your leverage.

And now, instead of pouring all your money into one property… you only have to put in $25,000.

Take your $100,000 and divide it by 25,000. That’s 4 properties you could buy with leverage. For the same out-of-pocket amount as buying 1 property outright.

However, because you’re now paying a mortgage on these rental properties, your monthly net rent goes down.

Your income is now $750 per property. Multiplied by 4 properties. So this brings in $3,000 per month, or $36,000 per year.

You have the potential to make an additional $21,600 per year – just from using leverage.

No matter what amount you start with (in this case, $100,000), using leverage brings in more income.

How Does Leverage Change Your Net Worth?

Monthly rent income isn’t the only way a rental property makes you money. It will also increase in value.

When a home appreciates, it increases your total net worth. The average yearly appreciation rate for real estate across the country is 5%.

It’s clear that leverage impacts income, but what about wealth?

Let’s throw this 5% number into our equation and see what happens with leverage.

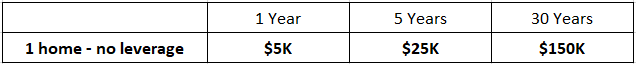

Net Worth No Leverage

If a property was purchased for $100,000, that one home would increase in value by an average of $5,000 per year.

So, the one home you bought outright would give you $150,000 in equity after 30 years.

You bought it for $100,000. After 30 years, you’re adding $150,000. So that’s a net value of $250,000.

Net Worth with Leverage

Next, let’s see the equity of the 4 properties purchased with leverage.

Multiply your 4 properties by the $5,000 in value they each increase every year. Your portfolio will appreciate $20,000 per year.

Over a 30-year span, your 4 properties would add $600,000 to your net worth. Add the original values of the homes (4 × $100,000), and your net worth increases by $1,000,000.

A million using leverage definitely beats the $250k you got from buying 1 home outright.

Read the full article here.

Watch the video here: