When should you use – and what is – a DSCR loan?

One of the most-asked questions we get:

“What is a DSCR loan?”

Where does it fit? What can we do with it? What do we need in order to get one?

In this post, we’ll go over: what is a DSCR loan, why it’s great, and where you should never use it.

What Is a DSCR Loan?

A DSCR loan replaces a conventional loan for investors. It’s never used for owner-occupied properties.

These loans are relatively simple:

- There are no personal income requirements (no W-2s, tax returns, etc). Instead, it’s all based on the income and expenses of the property.

- There are no business or experience requirements. Bank or conventional loans require a business to exist for 2 years or more before they’ll lend to you.

- They don’t need to see your portfolio. For other loans, lenders may ask to see what other properties you’ve flipped or rented. DSCR loans only care about the rental property at hand.

DSCR loans come in all shapes and sizes (3-year, 5-year, 30-year, 40-year), with a broad variety of details depending on lenders.

What Is the “DSCR” Part?

A debt service coverage ratio loan focuses on the debt ratio of the property. Does the rent pay for the expenses?

- Rent – The monthly income a property receives from tenants, based on comps.

- Expenses – Only mortgage payment, interest, taxes, insurance, and HOA fees. DSCR loans do not consider utilities, property management, or other expenses in this calculation.

One way to think of this ratio is: do you at least break even on this property?

To calculate a DSCR loan: Does Rent ÷ Income equal 1? If yes, you exactly break even. If it’s more than 1, then you have cash flow (and getting a DSCR loan will be even easier). But if this number is less than 1, the property costs more than it makes, and you’ll need a special kind of DSCR loan, likely with worse terms.

What Are DSCR Loans Based On?

Aside from a rental with a ratio of 1 or more, there are four main considerations in a DSCR loan:

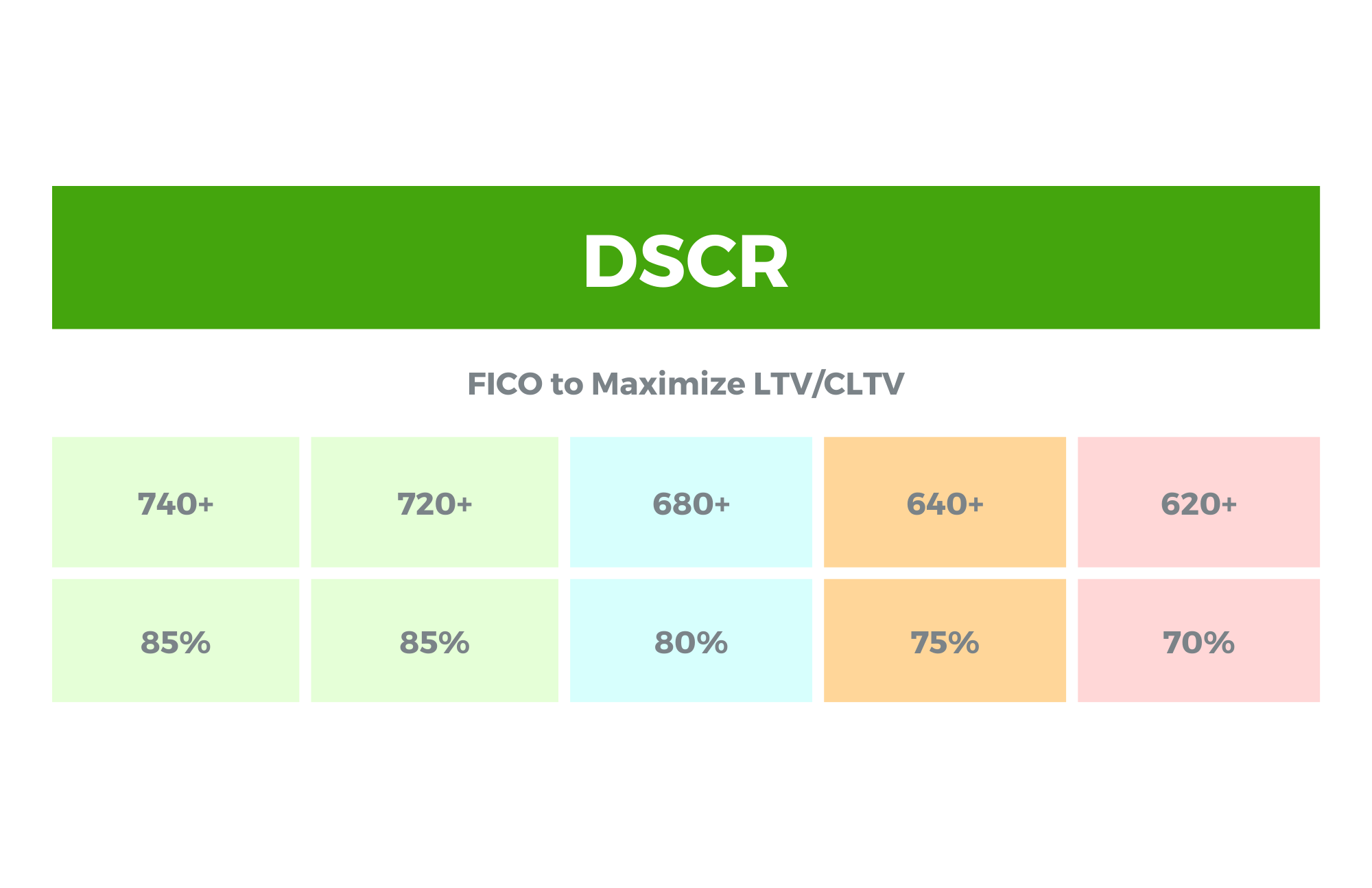

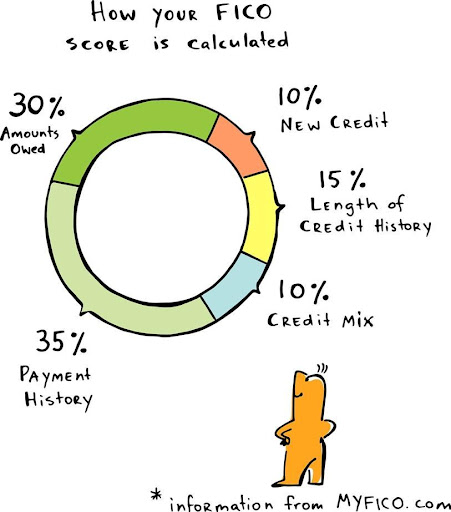

- Credit Requirements – Most DSCR loans look for borrowers with a 660 credit score or above. The better your credit, the better the LTV and interest rates you’ll get. With current high interest rates, you’ll want to have a score of 700 or more to get something affordable.

- LTVs – The loan-to-values DSCR lenders will give vary between 75 and 85 percent. For 80-85%, you can expect higher rates or higher fees.

- Type of Property – DSCR loans are good for up to 8-unit properties or mixed-use. Conventional loans only go up to 4 units and are much less flexible.

- Location – DSCR lenders are centralized in major metropolitan areas. If you’re investing in a smaller community (population of 25,000 or less), you’ll have a tougher time getting a DSCR loan.

Benefits of a DSCR Loan

Let’s go over all the positives of a DSCR loan:

- No income requirements for you – just the property.

- It doesn’t matter how old your business is.

- You can write everything off on your tax returns.

- Lenders don’t consider your other properties in the underwriting.

- You can buy in an LLC or company name.

- They have interest-only DSCR options.

- There is a variety of term lengths – from 3-year adjustable to 40-year fixed.

- They can be used for short-term rentals, like Airbnb or VRBO.

- A DSCR loan is a perfect long-term refinance loan for a flip project. It works great with BRRRR.

Downsides of a DSCR Loan

As a disclaimer to start: you should always shop around for DSCR loans.

There is no universal underwriting for DSCR, so every lender will be a little bit different. This product is extremely segmented. So while one lender might have a deal-breaking con, another one will have all the pros you’re looking for.

That being said, let’s look at some of the potential pitfalls of a DSCR loan compared to a conventional loan.

Interest Rate

A DSCR loan will have an interest rate somewhere between 1-3% higher than a conventional loan. Because, unlike the conventional market which is controlled by two pseudo-government agencies (Fannie and Freddie), DSCR is made up of hundreds of different investors who design these products. One lender may offer a rate of 6%, while the same client at another lender could only get 8-9%.

Prepayment Penalty

There are only a few states where DSCR loans don’t have prepay penalties. With a prepay penalty, there is a period (usually 3-5 years) where you must pay a fee if you want to pay off the loan. If you think you’ll want to sell or refinance the property within that time frame, DSCR might not be a cheap option for you.

For Rentals Only

DSCR loans are designed for investors with rental properties. You cannot use a DSCR loan for an owner-occupied property (aka, your personal home). These are business-based loans, so they do not follow the same standards as personal mortgages.

Credit

Since DSCR loans don’t look at your income, they do rely heavily on your credit score. Without a good score, you’ll have a hard time getting a DSCR loan (or at least one with decent rates).

Community and Loan Size

Lastly, DSCR loans aren’t ideal for smaller communities or projects. DSCR lenders typically only lend in cities with a population greater than 25,000. The lowest loan they’ll give is generally around $75,000.

How Do You Find the Right DSCR Loan

It’s always important to shop around for the best leverage, but this is especially true for the segmented market of DSCR loans.

Not sure where to start? Reach out to us at Info@TheCashFlowCompany.com.

We work with 10-15 different DSCR wholesale companies to find the best rates, highest LTVs, and lowest credit requirements.

Want to figure out if your deal works with a DSCR loan before reaching out? Check out this free DSCR calculator.