What is Peer to Peer Lending and Why You Need It

What exactly is peer to peer lending and why do investors need it? Peer to peer lending, also known as other people’s money, is funding that is provided by family, friends, or individuals within the community to help you in your investments. Here at The Cash Flow Company, we have done about a billion dollars over the past 23 years using peer to peer lending. The majority of this money is not from family and friends, but instead from other people who are interested in making a good return. Investors and business owners are looking for other sources for their financial needs, which is where peer to peer lending can be an excellent alternative to traditional bank loans.

Who makes up the peer to peer lending community?

Peer to peer means that working with other people in the community who have just as big of a need as you do. These individuals might be in your church or individuals who are in retirement and need some extra income. They might have some money in a 401K, IRA, or extra savings that they would rather lend to you. Whether it’s 6%, 7%, or even 8% secured, it can help you with closing costs, while helping them get a better return on their money.

Peer to peer is replacing banks.

We all know what is happening out there with affordability. The banks are starting to change their requirements, DSCR is getting into the 9% and 10% range, and fix and flip loans are anywhere between 11% and 13%. This lending squeeze is causing affordability, terms, and credit score requirements to all become tougher as well. Which creates the perfect opportunity to reintroduce peer to peer lending, which is something that has been around since before banking began. Peer to peer lending is taking out the banks and allowing people to begin working with humans again.

Peer to peer gets deals done quickly.

Every good investor always has a few peer to peer lenders that they work with on a regular basis. These are individuals that the investors have built a good reputation with, and proved that they can produce quality work. By creating this foundation, it allows investors to act quickly on deals that come available instead of waiting for the bank’s approval. Peer to peer lenders also benefit because they are able to use money from their savings accounts or retirement accounts in order to get a better return that is something secured. It’s a great win-win situation for everyone!

Something for everyone.

Every investor or business owner should look into peer to peer lending. Even if it is just for a down payment, fix up cost, or any other expense in the real estate world. Businesses could also benefit from peer to peer lending for start up costs or unexpected business expenses. It doesn’t have to be $500K, but it could be! With lending becoming tighter, banks could require an additional 10%. In that case, where would you go for the additional money? The answer is peer to peer! There are all kinds of people out there with pockets full of money. You just need to find one that has what you are needing.

No need to make things awkward

Again, peer to peer lending is funding that is provided by family, friends, or individuals within the community to help you in your investments. While we all know that borrowing money can create an uncomfortable situation, there are three steps you should follow to prevent this from occurring.

-

Make sure you are putting them in good deals both now and in the future.

These are deals that have a good chance of cash flowing. This can be done by making sure you have a good ARV or After Repair Value before jumping into a deal.

-

Make sure you do the proper paperwork.

Proper paperwork includes a real note, a mortgage, or a deed of trust that’s secured on a property. If you do it right and secure it with real estate, then they are in a good position as a lender.

-

Get out there and mingle.

You need to get out there and talk to real estate groups. Find out what they are doing, and who they are using for their peer to peer lenders. There are a ton of people who want to get into real estate, but they don’t want to get into the real estate game. Instead they just want a better return.

Start the process and do it right.

If you are a good keeper of other people’s money, then it will expand. You have to start the process, do it correctly, and come up with a good package to present to them. What should you include in your package or portfolio? Let’s take a look.

- What the property looks like

- Estimate of what the rent will be

- Include comps and additional research

- Proper documentation

- Your plans for the property (rent or keep)

- How the investment will be secured

Don’t take the cheapest path.

People try to take the cheap way out by not wanting to pay for the title, or record a deed because it’s going to cost money. The truth is, that all of those things are going to happen if you use a traditional lender. However, banks are going to charge more with higher interest rates. The better you make your peer to peer lender feel on the first few deals, the better the process will be in the future. It is imperative that you treat them like a real lender so that everything is official and secure. If it is done correctly, it will build a bridge that may bring more friends later on. Just to clarify, more friends does not mean adding more people onto a single note. Instead, these additional peer to peer lenders can be used separately for future investment opportunities.

Peer to peer keeps things simple.

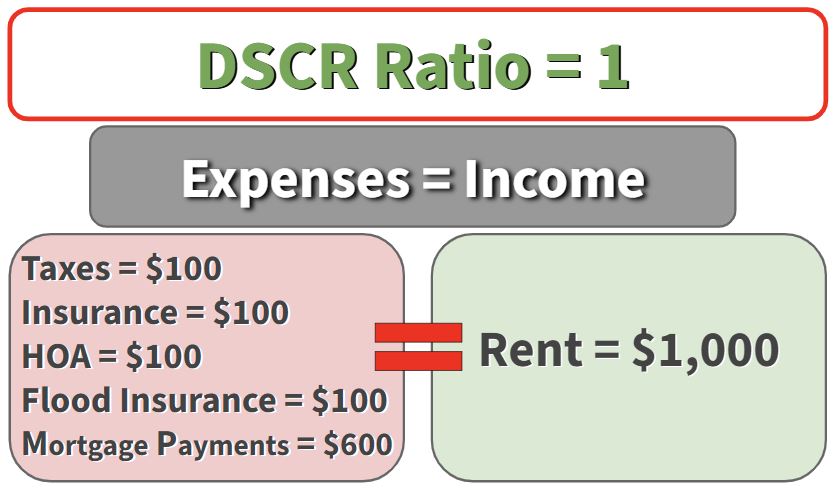

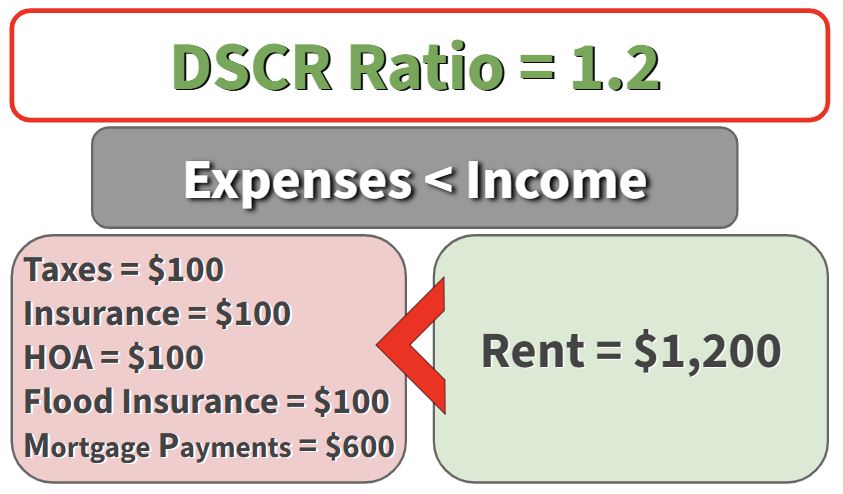

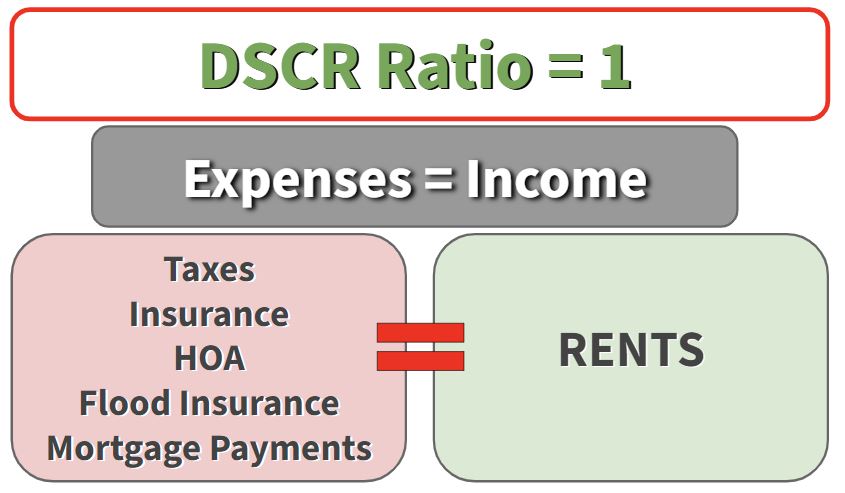

We want to keep it simple and find the people that fit your needs. Not everyone needs $300K or $500K. They might just need $35K or $50K to get their business going. While they do have real estate to secure a loan, they might not have the income that the bank requires. That is where peer to peer lending comes in. Most peer to peer lenders don’t care what your income is. They want to know what the property looks like, if it will protect their money, and what you are going to pay them. Another way to look at peer to peer lending is like a personal DSCR. A DSCR doesn’t care about your income either. With the high interest rates of DSCR in this market, peer to peer lending is a comparable option for investors with rental properties.

Double your money!

Peer to peer is so important for those who are lending. They can easily make $8K on $100K. Banks on the other hand, would only have a return of $4K to $5K on the same amount if it were in a CD or savings account. Peer to peer lenders could easily double what they are making without having to worry about the inconsistency of the stock market. This is a time when things are tightening and people are having to look for new opportunities. Those who are prepared, ready, and have money, will succeed.

Where do you start? We can help!

If you want to find out more about peer to peer lending and how to get started reach out to us. We have developed methods for both borrowers and lenders that will walk you through the process of getting started. We want to make sure that this market grows and that we get rid of some of the lenders and bankers out there. This will result in more money going into peoples accounts! The better it grows, the bigger it grows, and the more options people will have for their future. Our target is to make it a win-win for both peer to peer borrowers and peer to peer lenders.

Contact us today to find out more about the lowest risk lending option with the best return!

Watch our most recent video explaining What is Peer to Peer Lending and Why You Need It

We have created an excellent resource site for you to discover more about peer to peer lending. This information can be found at www.TheNoteShop.com.