How Interest Rates Impact Affordability (and Your Cash Flow!)

Categories: Blog Posts

Buying low and selling high all comes down to interest rates’ impact on affordability. Here’s what that means.

Building generational wealth with real estate depends on leveraging buyer affordability.

Interest rates and prices work like a seesaw. When interest rates go up, affordability and buying power go down, so prices go down. When interest rates come down, buyers can afford higher payments, so prices re-inflate.

So, where will we be in 2023, and how will prices play out? Interest rates are projected to be 8% – the highest they’ve been in years. Let’s look at an example of this seesaw effect.

Interest Rates’ Impact on Affordability

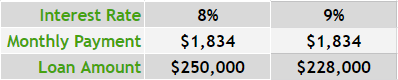

We’ll use 8% as an example, since that’s the projected average for next year. (But this math will work whether your interest rate is 7%, 10%, etc.).

Let’s say our buyer can afford a $250,000 house with an 8% interest rate. We can calculate that their monthly payments would be $1,834.

That monthly payment amount is important. We tend to think of a buyer’s budget as the purchase price they can afford. But really, a buyer’s budget is the monthly payment they can afford.

Even if a buyer is willing to pay a higher purchase price with high interest rates, their lender may stop them. A buyer qualifies for a loan based on the affordability of the monthly payment.

For an interest rate of 8% in 2023, buying power looks like this:

You can plug any numbers you want into this formula to figure out affordability.

For example, let’s say interest rates are 9%. The affordability doesn’t change – our buyer could still only swing a $1,834/month payment. Therefore, this homebuyer’s buying power goes down to $228,000.

Cash Flow with High Interest Rates

As you can see, the higher the interest rate, the lower the price. This is why you should buy while interest rates are high.

Prices will be lower than they have in a while. The challenge is that high interest rates make generating cash flow on properties more difficult. However, even if your rental property only breaks even every month – that’s fine for right now.

A little temporary cash flow loss is worth it when you’re on the path to generational wealth. When interest rates come back down, cash flow will accelerate through the roof.

Let’s flash forward our 2023 example a few years in the future.

Building Equity when Interest Rates Impact Affordability

Say we bought that $250k house at 8% in 2023. Three or four years later, the market has stabilized. More money is flowing in the economy and in real estate, driving interest rates back down. Inflation has calmed down to normal levels. Now, let’s say the average interest rate is down to 5%.

What’s the affordability of that 5% rate with our buyer who could qualify for a $1,834/month payment? Now, they can qualify for a $341,000 house.

That means the house you bought for $250k in 2023 could be worth $341k by 2027. This one property could create $91,000 in equity.

Of course, this isn’t a guaranteed timeline or number. But we know it’s close. Real estate operates with the seesaw of rates and prices, affordability and payments.

Refinancing Once Rates Fall

So you have $91,000 in extra equity. But here’s where the cash flow starts to kick in: You can now refinance the property from an 8% rate to 5%.

Your original loan will be down to about $245,000 after 4 years of $1,834 monthly payments. Refinancing $245k at the new 5% interest rate makes for monthly payments of $1,315.

This refinance would increase your monthly cash flow by $519.

Multiply that by 12 months in a year. By 10 more properties… And you’re on the track to generational wealth.

Read the full article here.

Watch the video here: