How can you use a HELOC for up to 100% financing for more real estate?

Flexibility. Cheap money. Fast closings. What every real estate investor wants, and what 100% financing can give.

A home equity line of credit should be a tool in every investor’s pocket. Here’s what you need to know about 100% HELOC financing: what it is, how to best use it in your investments, and what kind you should get.

What Is a HELOC?

A HELOC is a revolving line of credit secured by a property you own – either your owner-occupied residence or a rental property.

It allows you to borrow money as needed up to a predetermined limit, which is usually based on the amount of equity you have in your home.

You only pay interest on the amount you borrow, and you can use the funds for any purpose, including real estate investing.

Why Is HELOC Financing Important for Real Estate Investors?

HELOCs are a must-have for real estate investors because they provide a quick and easy way to access funding. Whether you need to close a deal quickly or get gap funding to cover the down payment or repairs, a HELOC can help you get the job done.

Here are 3 ways investors use HELOCs to fund their real estate deals:

Fund Any Deal You Want

If you have enough equity in your house, you could make a down payment, fund the rehab, or purchase the whole property with 100% HELOC financing.

We had a recent client find a great real estate deal in Oklahoma, where property and fix-up, all in, was $49,000. With a HELOC, that becomes an easy transaction to fund by yourself. You can skip all the trouble of going to a lender.

HELOC financing is especially useful for auction properties – you can get your funding within a day, pay for the property (or at least the down payment) all yourself, and stop missing great deals that cross your path.

Gap Funding

Another major use for a HELOC is gap funding. Gap funding supplies money for all the smaller things a primary loan or mortgage won’t cover.

You could take money from this line of credit, and use HELOC financing for:

- Down payment

- Repairs and rehab

- Earnest money, if a buyer needs funds to hold a property for you

- Reserves, if your primary lender requires you to have a certain dollar amount on-hand for emergencies

- Carry costs, to make loan, insurance, and other payments during the rehab

Using HELOC is the cheapest way you could fund these gaps in your loan.

Put More Down on a Property

So the third way that people use HELOCs is to put more down on a property to get better loan terms and rates.

If the bank requires another 10% more than what you have, then you can take money out of the HELOC to use. This could mean the difference between getting back financing instead of hard money or private lending.

Even if the bank doesn’t require the extra 10%, the more you can put down upfront, the more you save overall in better rates and terms.

Even if your HELOC isn’t big enough to fund an entire project, it can help you save money in smaller ways like this.

Pros & Cons of Using a HELOC for Financing

Like any financial product, there are pros and cons to using a HELOC for real estate investing. Let’s look at a few.

HELOC Financing Positives

- Little to no fees. Sometimes, you might have to pay $100 or $200 to get a HELOC on your property, but there are usually little to no fees.

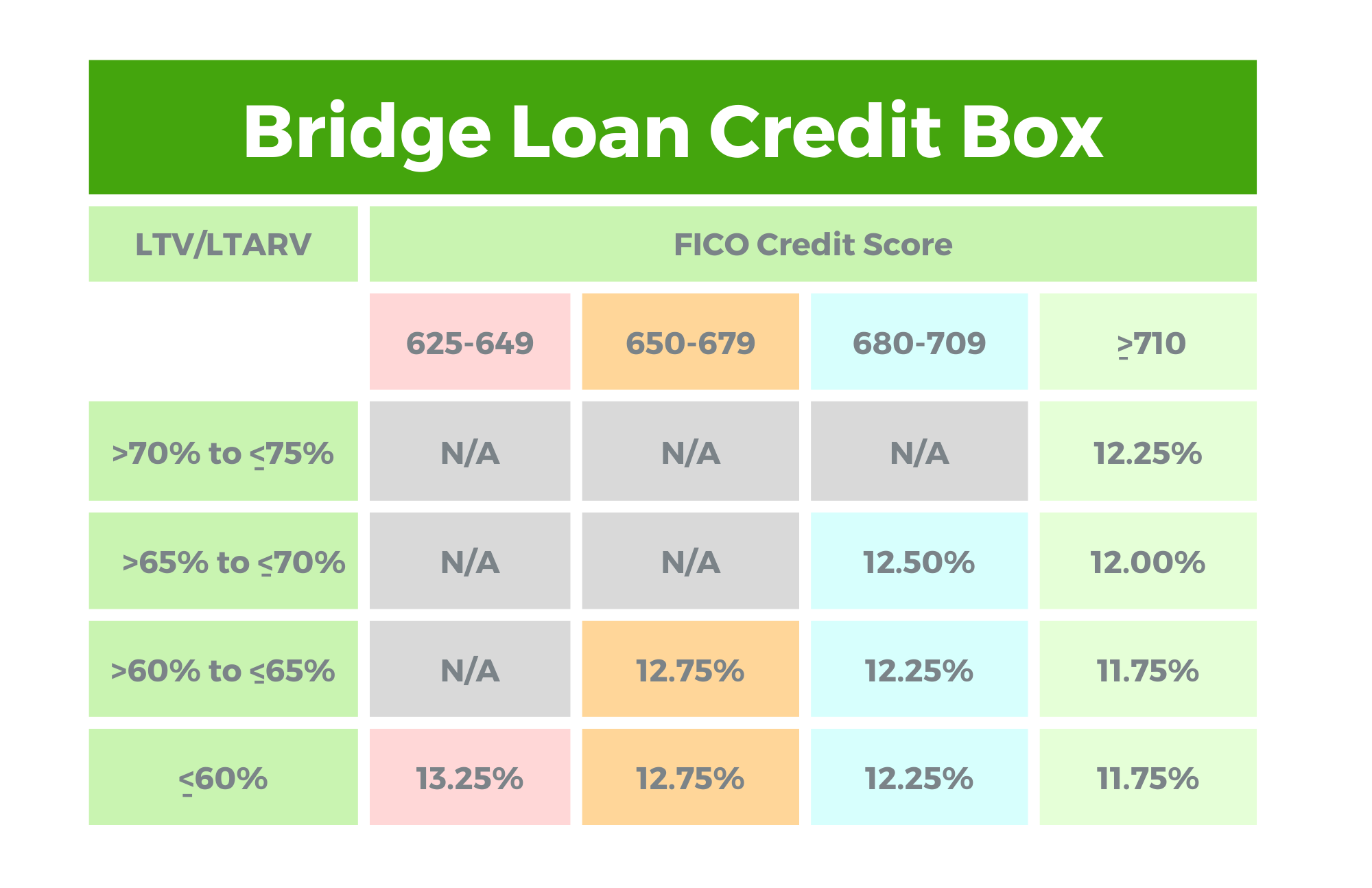

- Lower rates. You’ll see adjustable rates or fixed rates. Depends on what you get, but a HELOC is usually cheaper than private money or hard money. Rates could even be as low as bank financing. You don’t pay interest unless you’ve taken money out.

- Quick funding. You can fund a deal in as little as one day, giving you more control over the process. You can get the money as a wire from a bank, a check, or even a debit card connected to the line of credit.

Negatives of Using HELOC Financing

- You must own a property. You need to own a property with equity to get a HELOC. In your owner-occupied property, most banks will go up to 95-100% of the equity. So even if you only have $20,000 in equity on your home, you can still take it out for gap funding or carry costs, even if you don’t get 100% HELOC financing.

- You need good credit. Most banks require you to get approved through income. Both credit and debt-to-income are important factors in whether you can get a HELOC or not.

- Misuse of funds. A HELOC is as easy to misuse as a credit card is. There’s always the risk that if you don’t pay back the funds when your real estate project is done, you’ll have too many liens on your home. Treat this line of credit like a business, and pay it off once you sell or refinance a property.

How a HELOC Works

A HELOC is like a large credit card attached to a house. You can re-use and pay off these funds over and over.

HELOC Financing vs Credit Cards

Your HELOC might function like a credit card, but it doesn’t have rates like a credit card.

Interest rates on a HELOC are around half to a third of the cost of credit card rates. HELOCs also don’t have cash limits like most credit cards. You could take your entire HELOC out in cash if you’d like, with no fee for wiring or withdrawing.

Owner-Occupied vs Rental Property HELOCs

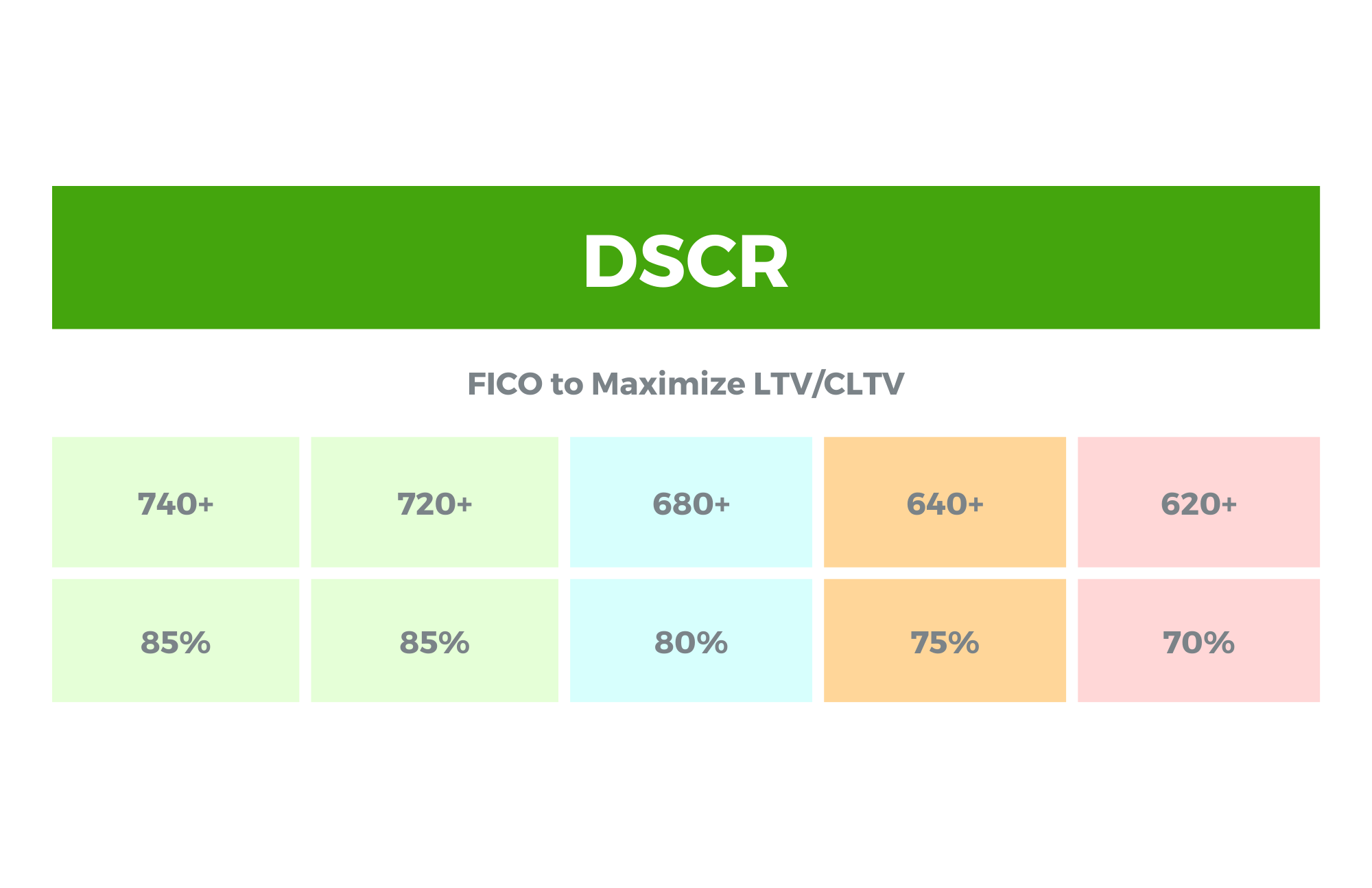

You can also get a HELOC on multiple different properties you own. Here’s what you can generally expect as far as LTVs:

- For a HELOC on an owner-occupied home, you can get all the way up to 95-100% of your equity available to you.

- For a rental, the LTV caps out at 65-70% equity. You’ll have to have more equity in a rental property to make a HELOC worthwhile.

Length of the Line of Credit

A HELOC comes with a draw period. Once this period is over, they become a standard loan where you have to pay off the balance over a term just like a mortgage.

The draw period (when you can use it like a credit card) usually lasts 5-10 years.

To combat the switch to a normal loan, you can always refinance into a new HELOC. For example, you could refinance your HELOC with a five-year draw period after four and a half years. Then, you can always keep drawing on it.

Example of How a Real Estate Investor Could Use a HELOC

Let’s say you have a HELOC of $100,000. How can you use that in a real estate deal for 100% HELOC financing?

- You find a property you want to put under contract, so you need $2,000 for earnest money.

Instead of going to a lender or putting up your own cash, you go to your bank, have them cut you either a cashier’s check or a check on your account, put it with the title, and now you have earnest money on your account.

You now have $98,000 available in your HELOC. You’re only paying interest on $2,000.

2. Next, you need to put in a down payment and closing costs of $10,000 total. You call your bank and have them wire it to the title company from your HELOC.

You now have $88,000 still available, and you’re paying interest on $12k.

3. Now you’re doing your projects. You need to make repairs, pay the mortgage or hard money loan, and cover taxes.

You could put a bunch of money from your HELOC in your checking account up-front, draw from it monthly, or ask your bank about a debit card. All the expenses could go on this card – you just have to keep good accounting.

Let’s say you’ve spent $30,000 total on mortgage payments, paying contractors, and other costs. This means you took $42,000 total out of your HELOC.

Note: You’re not paying interest on the full $100k limit of your HELOC. You only pay interest on the amount you’ve taken out – in this case, the $42k.

4. Lastly, you sell the property or refinance it as a BRRRR. You take these funds and put it back on your line of credit.

Now, you have $100,000 again to use on your next project.

What Kind of HELOC Should You Get?

This is the beauty of a HELOC. You’re in control. You don’t have to wait for lenders or appraisals or paperwork. You get to use the money however you need to.

HELOCs are great tools. If you have the equity, the credit, and the income, it’s vital that you find the best HELOC for you.

They come in different shapes and sizes – adjustables, fixed 5-year periods, 10-year periods. If you want help figuring out which HELOC is best for you, download this free, quick HELOC questionnaire.

Reach out at Info@TheCashFlowCompany.com with any other questions. We want our clients to get the best credit available.