2024 Real Estate Investing: Are High Interest Rates Worth It?

Categories: Blog Posts

2024 Real Estate Investing: Are High Interest Rates Worth It?

Today we are going to discuss real estate investing and whether or not it’s worth paying high interest rates in 2024. Over the past few years there has been a huge shift in the market. The banks are swimming upstream in search of the best and investors are having a difficult time qualifying for financing. While many people may run away from investing right now, this is actually the best time to jump in. Those who do will benefit greatly when rates go back down. What do you need to do to ensure success? Let’s take a closer look.

1. Focus on the lower end of the market.

With interest rates being so high right now, it is important that you focus on the lower end of the market. What do we mean by the lower end of the market? These are homes that are in the $300K range as opposed to $500K or above. It is important to keep affordability in mind as well if you are flipping a property. Affordability is key because someone will need to be able to afford to buy the house when you are finished.

2. Create a good product to guarantee a sale.

Especially for those who are fixing up properties, it is crucial that you have a nice fixed up property to sell. It is more likely that a fixed up property will sell, as opposed to one that needs work. In today’s market there is an inventory shortage for investors and a growing demand for properties. If you are at a good price point and have a good product, then you will win in this real estate game.

3. High interest rates now will create cash flow later.

Keep in mind interest rates and how they will affect your monthly budget. Properties that will at least break even, or better yet cash flow, will create wealth in the near future. Predictions are indicating that rates will come back down later this year. When they do, more people are going to jump into the market. Many people have been waiting on the sidelines for things to go back down. By buying now, you will be ahead of the crowd with a property that is worth more, thus creating more cash flow!

4. Do it correctly to prevent being upside down.

It is a great time to jump in! If you can buy something low and make it work now. Then when rates go back down, you are creating that wealth.

| Purchase Price | Overpaid | Two years from now | Equity | |

| A few years ago | $350K | $100K | $325K to $350K | $0 |

| Today | $250K | $0 | $325K to $350K | Created equity |

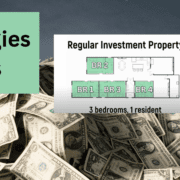

5. What is a good property?

In order to succeed in this market it is very important that you buy good properties. What is a good property? It is one that is not on corners, busy streets, or near a commercial area. A good property on the other hand is one that is in culdesac or near parks. These types of properties are what you should be focusing on to ensure success.

6. Why should I get into real estate when others are running away?

All of the negativity out there is keeping people out of the market an driving away those who have been in real estate for awhile. In years past there were some really good deals available and it was easier to qualify for lending. Nowadays, the banks are swimming upstream in search of the best of the best. This decrease in competition creates the perfect opportunity for new investors to begin their real estate investment journey.

7. Set yourself up for success!

As a new investor you need to make sure that you set yourself up for success. Those who stand out to lenders and have more buckets of money will set themselves up for success. Real estate investing is all about using other people’s money in order to create wealth. Contact us today to find out more about getting your lending buckets set up!

There is going to be less real estate investors and less money out there. However, there are going to be more deals than there were before. These deals will have better margins and will create a greater opportunity for wealth in the future. Contact us today to find out more!

Watch our most recent video about 2024 Real Estate Investing: Are High Interest Rates Worth It?