These numbers show you when it’s time to turn your flip into a rental.

What do you do with a flip that won’t sell?

The question is: is it smarter to leave the house on the market and keep dropping the price? Or take it off and turn it into a rental now before rates go further up and prices further down?

You don’t want to sell for a price that loses you money. But if you refinance into a rental, you know it’ll be negative cash flow.

It can feel lose-lose. But we can show you the better way out.

Let’s go over the numbers behind this, so you can look at this problem clearly. Here’s what it will look like if you turn your flip into a rental now.

How Bad Is the Negative Cash Flow?

The hesitation for many investors in this situation is: if you take the property off the market, the house has negative cash flow. The price is too high, and the rent probably won’t cover the costs. Why would you intentionally put yourself in a situation where you’re losing money?

But the reality is: the house is a negative cash-flowing property now. Every month the house is on the market, you pay interest. That money adds no value to the property – you’re just draining your money straight into your lender’s pocket.

Even if you don’t refinance with a rental loan, you already have a negative cash flow property.

Why not take the step to turn your flip into a rental now and reduce the amount of money you’re losing each month?

Refinance a Flip To a Rental

Typically, people spend more money leaving a house on the market for 2 or 3 months than they would turning it into a negative cash flowing rental for 2 years.

Would you rather pay $2,500 per month on a house with a for sale sign on it? Or get $2,200 in rent and only pay $300 of your own money per month? This is the question you’re left with when your flip isn’t selling in this market.

Turning a Flip to a Rental in Past Down Markets

Take a lesson from 2008 and 2009. Many investors who sold during the crash later realized that if they had waited 3 or 4 years, they could have made their money back on those properties.

Not only would their property values have gone up, but rates would have come down. Those properties would have become major assets. Instead, investors took a big hit selling in a down market.

Negative DSCR and No-Ratio Loans

So if you decide to go with this negatively cash flowing property, what are your options for a loan?

Let’s go over the negative DSCR and the no-ratio loan programs.

These loans allow you a 30-year fixed product that’s interest-only. These DSCR loans work even on properties that aren’t cash flowing.

Typically for a DSCR loan, the rent from the property has to at least cover the monthly expenses (principal, interest, taxes, and insurance). Outflow has to equal inflow.

But these negative DSCR and no-ratio options allow you to refinance rental properties even when you bring in less rent than you pay out per month.

Refinancing with Bridge Loans vs DSCR

Getting a DSCR or no-ratio loan from a new lender is typically a better move than continuing to refinance with bridge loans from your current lender.

You don’t know where the market will be in 12 to 24 months. We know that long-term, the markets will come back, but what if that doesn’t happen for 3 years? You could get stuck refinancing with a bridge loan year after year, charging points with each refinance.

DSCR loans are often a better option in this situation. You just have to know your numbers.

Let’s go through an example so you know exactly how to calculate a DSCR loan and see if it’s the smart choice for you.

Using a DSCR Loan to Combat Negative Cash Flow: The Numbers

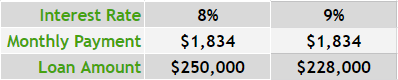

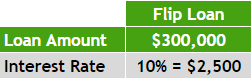

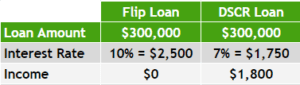

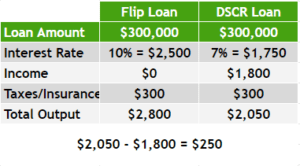

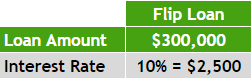

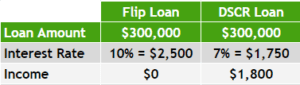

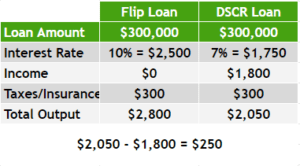

Let’s look at an example with a $300,000 loan. We’ll assume that both the original flip loan and the DSCR loan you’re refinancing into are interest-only.

This $300,000 flip loan has a 10% interest rate. That means you’re paying $2,500/month just for interest. This is the current negative cash flow of the property.

On the other hand, if you can get a DSCR loan for a 7% interest rate, you’d be paying $1,750/month instead. Plus, you could get a tenant renting for $1,800/month.

At this point, $1,800 would be coming in, and $1,750 would be going out for mortgage payments. This is actually a positive cash flow of $50/month.

However, your mortgage isn’t your only expense on this property. We still have to take taxes and insurance into consideration. Let’s say both of those costs add up to $300 per month.

This raises the total expenses with a DSCR loan to $2,050 per month, bringing the cash flow to a -$250 every month.

This raises the total expenses with a DSCR loan to $2,050 per month, bringing the cash flow to a -$250 every month.

Flip Loan vs DSCR Loan Compared

Obviously, you never like to lose money on a property. But that $250 of negative cash flow multiplied by 12 months is only $3,000. After 2 years, it’s $6,000. That may seem like a lot, but let’s look back at what you’d spend with the original flip loan.

If we go back to our example, remember we’d be paying $2,500 per month in interest, plus $300 in taxes and insurance with the original flip loan. That’s $2,800 spent for 1 month with the flip loan – close to the $3,000 for the full year with a DSCR loan!

If you keep the house on the market with this flip loan for 2 months, it’s $5,600. That’s comparable to 2 years of out-of-pocket costs if the same property was converted into a rental.

This is how you have to look at the numbers in this scenario. It will help you determine what’s right for your flip. Is it better to wait for the market and shell out thousands of dollars in the meantime? Or rent the property with a little negative cash flow for 2-3 years in hopes of recouping an extra $100k in equity when the markets come back? (Or at least until rates come back down so you can refinance?)

In many cases, it makes more sense to turn your flip into a rental ASAP with a negative DSCR or no-ratio loan.

What Should You Do Next?

If you feel ready to refinance your flip into a rental, act quickly. Rates are going up, prices are going down.

There are some downsides to no-ratio and DSCR loans. Let us know you’re looking, and we’re happy to help you find the best loan for your situation.

The Cash Flow Company looks at hundreds of loans every month to find the best terms for investors, with the lowest down payments, highest LTVs, and best rates. Let us run the numbers on your property, and we’ll let you know what product will be best for your situation.

We want to get you to a place where you reduce negative cash flow and get back into some profitable flips. Email us at Info@TheCashFlowCompany.com.